Generic Drug Rebates: How to Save on Prescription Costs

When you hear generic drug rebates, cash-back offers or discounts on brand-name drugs that have cheaper, FDA-approved copies. Also known as prescription savings programs, these rebates help millions of people pay less for the exact same medicine without switching brands. They’re not just for the wealthy — many are designed for seniors, low-income families, and even people with insurance that still leaves them paying too much out of pocket.

One of the biggest players in this space is Medicare Extra Help, a federal program that lowers monthly premiums, annual deductibles, and copays for Part D prescription drugs. For eligible seniors, it cuts the cost of low-income subsidy generic prescriptions to as little as $4.90 per fill. That’s not a promo code — it’s a legal, government-backed discount you can apply for online. But rebates aren’t only for Medicare users. Pharmacies, manufacturers, and even retailers like Walmart and Costco offer their own generic drug savings cards, often with no income limits.

Not all rebates are created equal. Some require you to sign up months in advance. Others only work with specific pharmacies or require you to mail in paperwork. The best ones are automatic — like when your pharmacy card applies the discount at checkout without you doing anything extra. And while some people think rebates mean lower quality, that’s a myth. Generic drugs have the same active ingredients, strength, and safety standards as brand names. The only difference? They cost 80% less on average.

What’s missing from most people’s strategy? Knowing which drugs are covered. Not every generic gets a rebate. But the most common ones — metformin for diabetes, lisinopril for blood pressure, atorvastatin for cholesterol — almost always do. If you’re taking one of these, ask your pharmacist: "Is there a rebate I can use?" You might be surprised how much you’re leaving on the table.

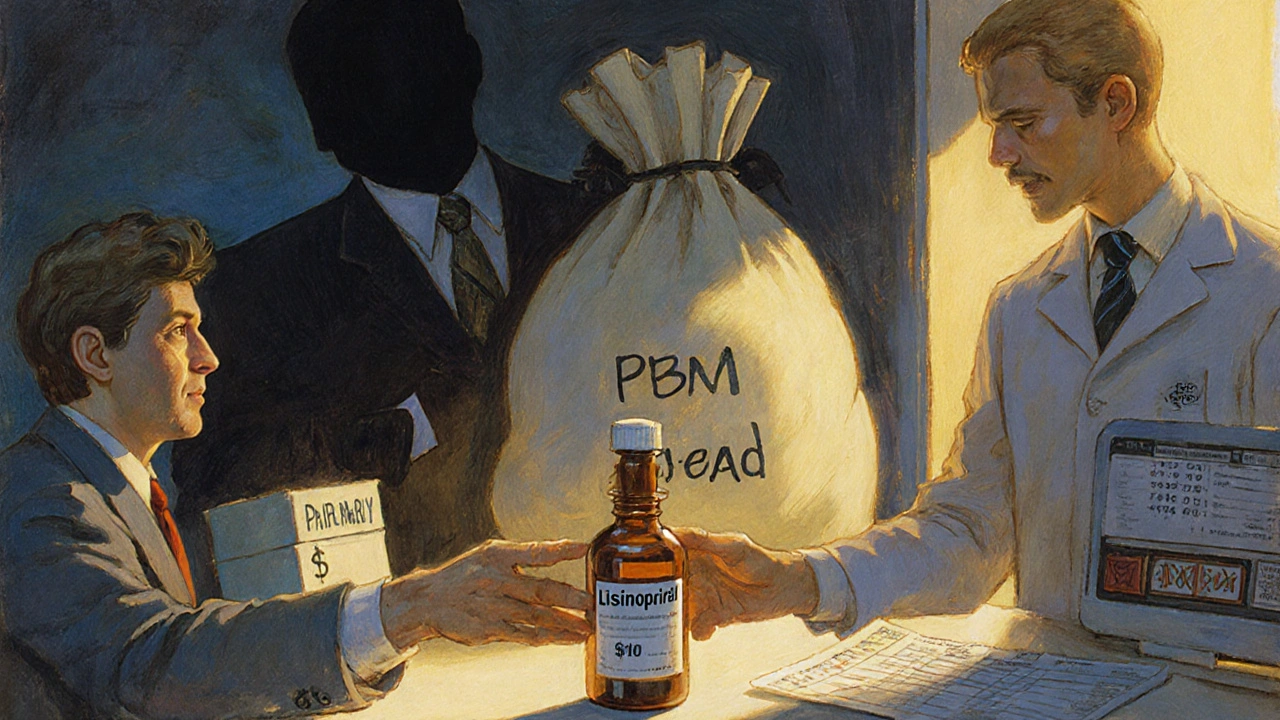

There’s also a hidden layer: manufacturer rebates. Drug companies sometimes offer coupons directly to patients to help them switch from a brand to a generic. These can stack with insurance or Medicare. But be careful — some coupons only work if you’re paying full price, and they can’t be used with government programs like Medicaid. Always check the fine print.

And here’s the thing: these rebates aren’t just about saving money. They’re about staying on your meds. When people can’t afford their prescriptions, they skip doses. That leads to hospital visits, worse outcomes, and higher costs down the line. A $10 rebate on a monthly pill can mean the difference between health and crisis.

Below, you’ll find real guides on how to use these programs — from applying for Medicare Extra Help to spotting safe online pharmacies that honor rebates. You’ll see how people are cutting their drug bills in half, without sacrificing safety or quality. No fluff. No hype. Just clear, practical steps to get the savings you’re already eligible for.