Insurance Drug Costs: How to Save on Prescriptions and Understand Your Coverage

When it comes to insurance drug costs, the amount you pay out of pocket for prescription medications after insurance applies. Also known as out-of-pocket drug expenses, these costs can spike unexpectedly—especially for chronic conditions or brand-name drugs. Many people assume their insurance covers most of the bill, but copays, deductibles, and formulary restrictions often leave them paying hundreds a month. The truth? You’re not alone, and there are proven ways to cut those costs without sacrificing care.

Medicare Extra Help, a federal program that reduces prescription drug costs for low-income seniors on Medicare Part D. Also called the Low-Income Subsidy, this program can bring your generic drug copay down to just $4.90 per fill. It’s not just for people on Medicaid—many don’t qualify because they don’t know the income limits are higher than they think. Then there’s generic prescriptions, the exact same medicine as brand-name drugs but often 80% cheaper. Yet, many patients stick with expensive brands because their doctor didn’t suggest a switch, or their pharmacy didn’t offer the generic option. And don’t overlook drug assistance programs, free or low-cost medication plans offered by manufacturers for people who can’t afford their prescriptions. These aren’t charity cases—they’re structured programs with simple applications, often available for diabetes, heart disease, and mental health meds.

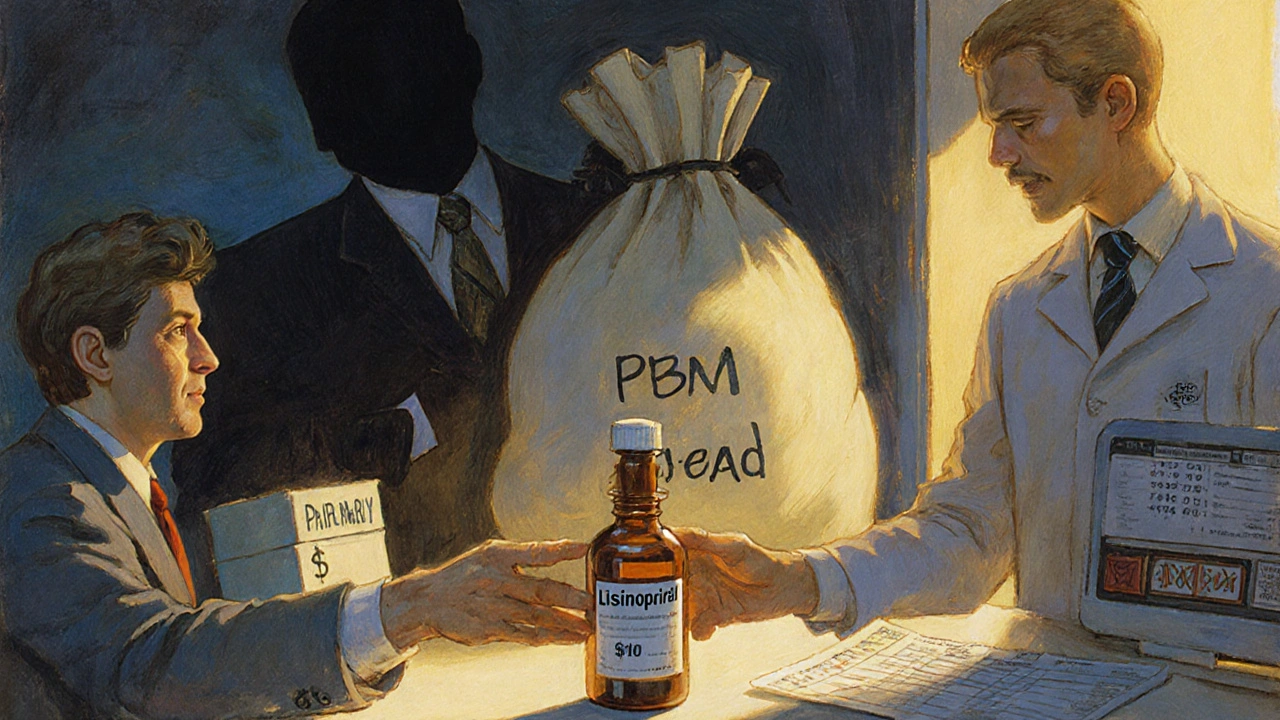

Insurance drug costs aren’t just about what your plan says—they’re about what you know. A single medication like metformin or lisinopril can cost $5 with Extra Help and $50 without. A drug like insulin might drop from $300 to $35 if you apply for patient assistance. It’s not magic. It’s knowing where to look. The posts below show you exactly how real people lowered their bills—whether they were using Medicare Extra Help to stretch their budget, switching to generic antibiotics like tetracycline or Bactrim, or finding free alternatives to expensive liver or diabetes meds. You’ll see step-by-step guides on checking REMS requirements before starting a high-risk drug, avoiding dangerous interactions like red yeast rice with statins, and even how to verify if an online pharmacy is safe when buying cheap generics. No fluff. No jargon. Just what works.