PBM Spread Pricing: What It Is and How It Affects Your Prescription Costs

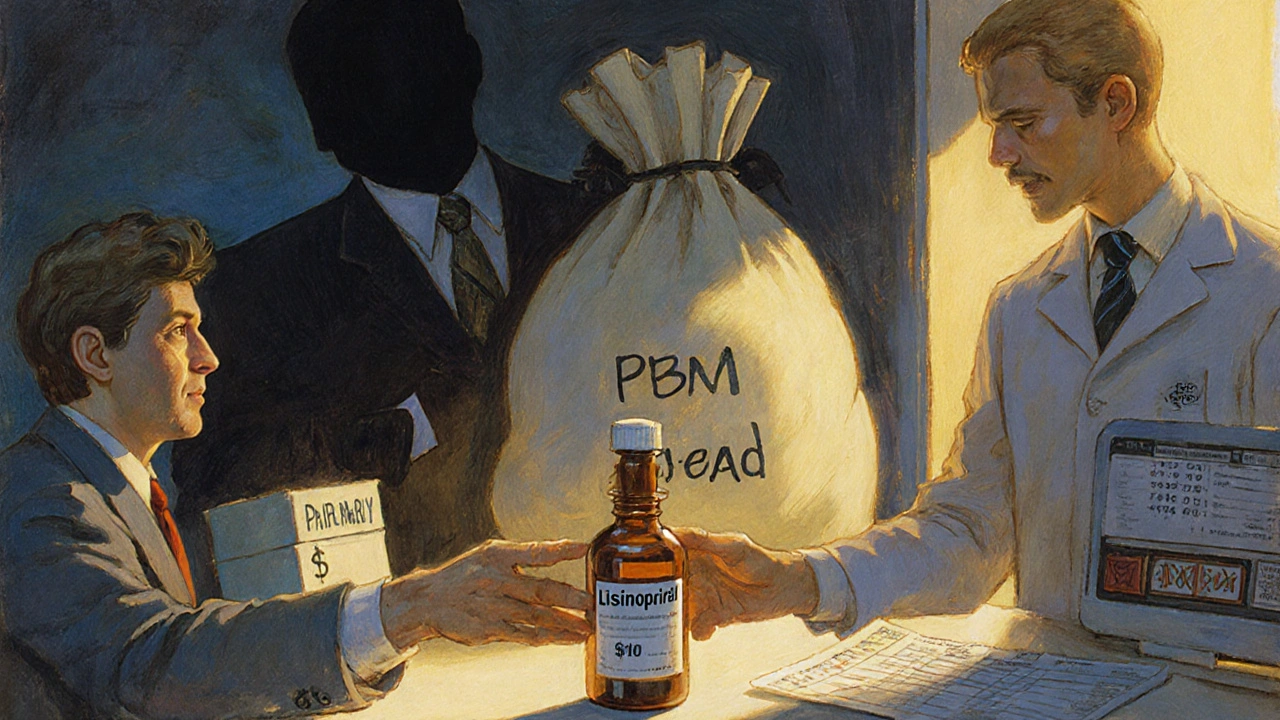

When you pick up a prescription, you might think the price you pay is based on what the pharmacy paid for the drug. It’s not. Behind the scenes, PBM spread pricing, a hidden practice where pharmacy benefit managers charge insurers more than they pay pharmacies. Also known as price arbitrage, it’s a major reason why your copay feels higher than it should be, even for generic drugs. PBMs — pharmacy benefit managers — act as middlemen between insurers, pharmacies, and drug makers. They negotiate prices, manage formularies, and process claims. But instead of passing along the real cost, they keep the difference between what they charge the insurer and what they pay the pharmacy. That gap? That’s the spread. And it’s often hidden from patients, doctors, and even some pharmacies.

This isn’t just about big corporations making money. It hits real people. Seniors on Medicare Part D, low-income patients using Extra Help, and even those with private insurance are paying more than necessary. For example, a generic drug might cost the pharmacy $2.50, but the PBM charges the insurer $15 — and you’re stuck paying a $10 copay. Meanwhile, the pharmacy gets paid $2.50 and loses money on the transaction. The PBM pockets $12.50. This system encourages pharmacies to fill prescriptions at a loss just to stay in network, while patients get billed inflated prices. It also makes it harder to compare real drug costs across pharmacies. You might think Walmart or Costco is cheaper, but if the PBM’s spread is hidden, you’re not seeing the full picture.

PBM spread pricing is directly tied to the drug pricing crisis we see today. It’s why some medications cost more in the U.S. than anywhere else, even though the manufacturing cost is low. It’s why you hear about insulin prices skyrocketing while the actual drug cost stays flat. And it’s why some patients skip doses — not because they can’t afford the drug, but because they can’t afford the markup the PBM added on top. There are laws being passed to ban this practice in some states, and Medicare is starting to require more transparency. But until then, you’re still paying the price.

Below, you’ll find real stories and guides about how drug pricing works behind the scenes — from how Medicare Extra Help cuts your copays to why red yeast rice can be dangerous when mixed with statins. These aren’t just drug reviews. They’re about understanding the system that sets the price before you even walk into the pharmacy.