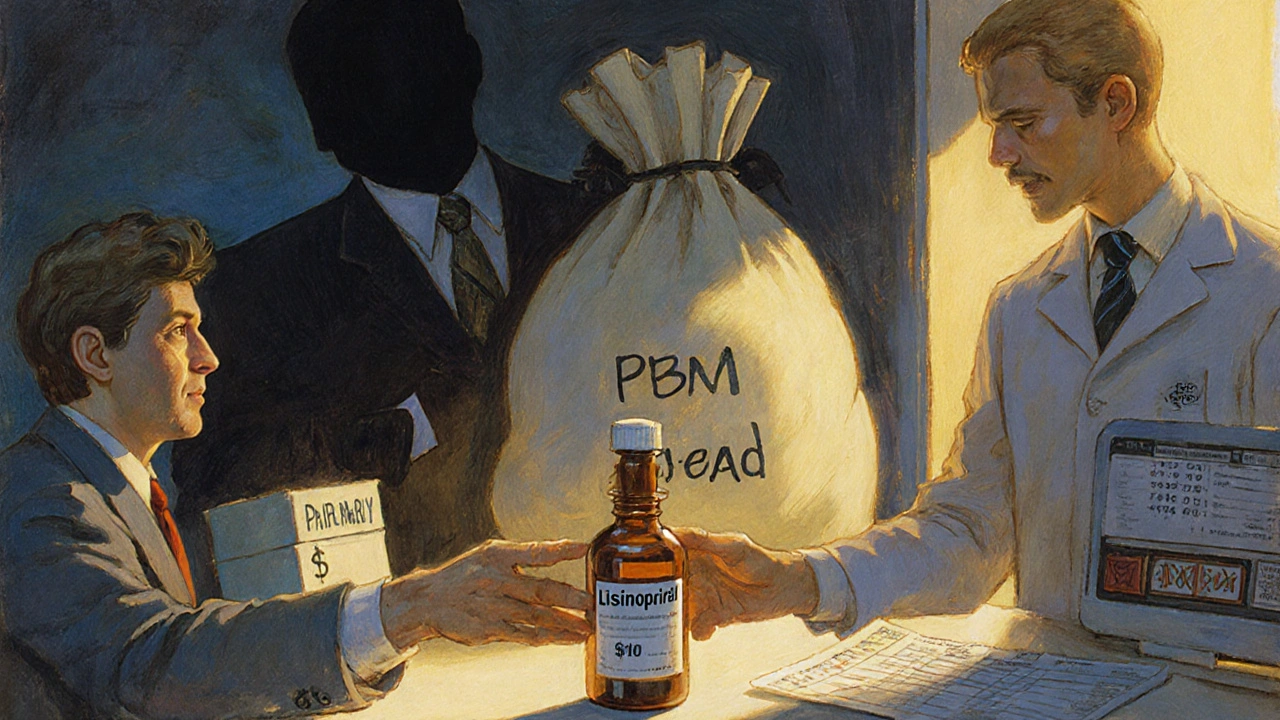

Pharmacy Benefit Managers: How They Control Your Drug Costs and Choices

When you pick up a prescription, you might think your doctor and pharmacist are the ones deciding what you get. But behind the scenes, a hidden player — the pharmacy benefit manager, a middleman that negotiates drug prices and sets rules for insurance coverage. Also known as PBM, it controls which drugs are covered, how much you pay, and sometimes even if you can get the medicine your doctor prescribed. These companies work with your insurance plan, Medicare Part D, and employers to cut costs. But their rules don’t always match your needs.

How do they do it? They build formularies, lists of approved drugs that insurers will pay for. If your drug isn’t on the list, you pay more — or nothing at all. They also push for generics, even when the brand name works better for you. And before you can get certain drugs, you might need prior authorization, a paperwork hurdle where your doctor proves you need that specific medicine. This isn’t just bureaucracy. It’s a system designed to save money, not always to help you.

These rules affect real people. Someone with diabetes might be forced to switch from a brand-name insulin to a cheaper generic — only to find it doesn’t control their blood sugar as well. An older adult on multiple meds might get hit with surprise costs because their PBM moved a drug to a higher tier. Even when you’re on Medicare Extra Help, the PBM still decides what’s covered and what isn’t. And if you’re taking something like methotrexate or amiodarone — drugs with serious side effects — the PBM might restrict access because they’re expensive, even if your doctor says you need them.

The posts here cut through the noise. You’ll find real advice on how to fight back: how to check if your drug is on formulary, how to appeal a denial, and how to find cheaper alternatives that actually work. We cover drug interactions that PBMs ignore, like red yeast rice with statins, and how to spot when a PBM’s cost-saving move could hurt your health — like with NSAIDs and kidney damage, or fluoroquinolones and tendon rupture. You’ll learn how to use Medicare Extra Help to lower your out-of-pocket costs, and how to avoid being stuck with a drug that doesn’t fit your body.

This isn’t about blaming PBMs. It’s about understanding them. Because if you don’t know how they work, you’re leaving money on the table — and maybe your health too. Below, you’ll find practical guides from people who’ve been there: how to navigate REMS requirements, how to manage complex drug regimens after a transplant, and how to protect your liver, kidneys, and heart from the hidden risks of medications that PBMs still push because they’re cheap. You’re not powerless. You just need to know the rules.