When a brand-name drug loses its patent, it’s not the end of the road for the company that made it. Instead, many of them do something unexpected: they launch their own generic version. This isn’t some loophole or side hustle-it’s a calculated move called an authorized generic. And it’s reshaping how drugs are priced, prescribed, and bought across the U.S. healthcare system.

What Exactly Is an Authorized Generic?

An authorized generic is the exact same drug as the brand-name version-same active ingredients, same inactive fillers, same tablet shape, same manufacturing line. The only difference? No brand name on the label. It’s made by the original company, under the same FDA-approved New Drug Application (NDA), and sold at a lower price under a private label. Think of it like this: You buy a Coca-Cola. Then, the Coca-Cola company starts selling the exact same soda in a plain bottle with no logo. Same taste, same formula, same factory. But now it’s cheaper. That’s an authorized generic. Unlike regular generics, which must prove they’re bioequivalent through an Abbreviated New Drug Application (ANDA), authorized generics skip that step entirely. They’re not new drugs-they’re the original drug, just repackaged. That’s why they’re not listed in the FDA’s Orange Book, which tracks approved generics. The FDA itself says they’re therapeutically equivalent because they’re literally the same product.Why Do Brand Companies Do This?

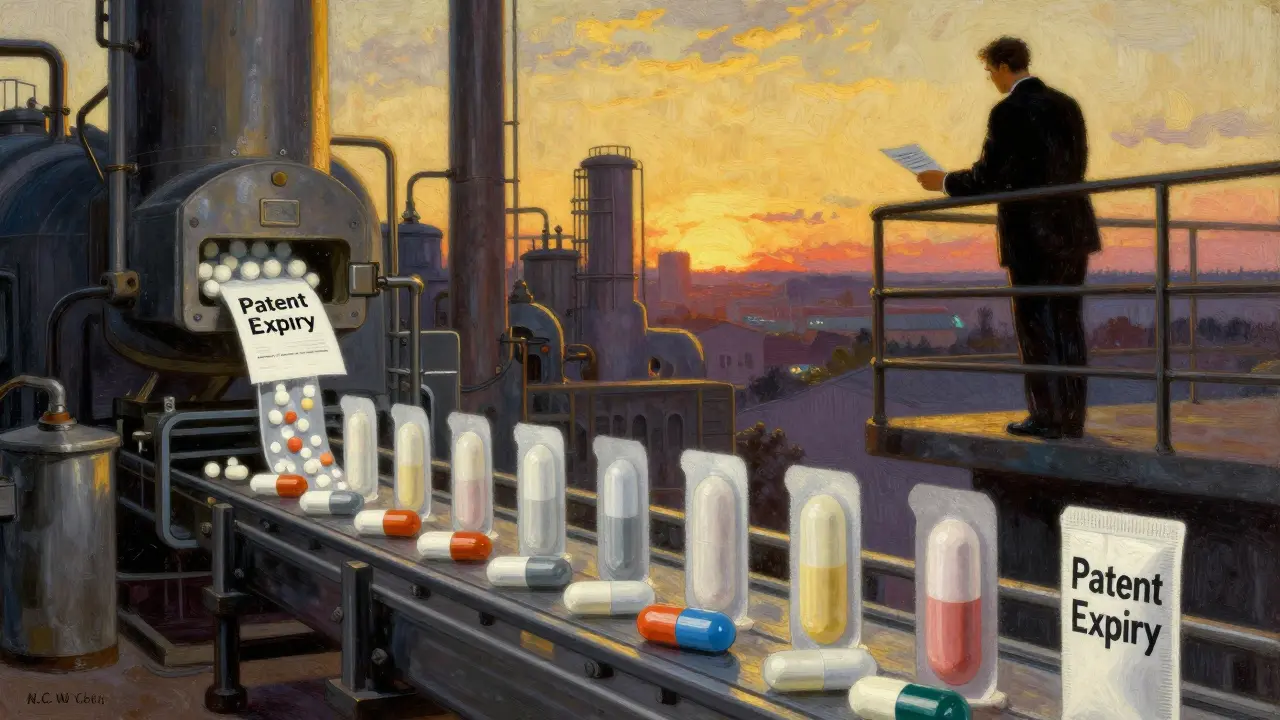

Patent expiration is a financial earthquake for drugmakers. Once a drug goes generic, prices can drop 80-90% within months. Revenue plummets. So what do they do? They don’t just sit back and wait to be replaced. They get ahead of it. The timing matters. Under the Hatch-Waxman Act, the first company to file a generic version gets 180 days of exclusive market access. That’s a huge advantage. But if the brand company launches its own generic right before or during that window, it splits the market. Suddenly, instead of one generic competitor, there are two: the first generic and the brand’s own version. This isn’t just about protecting profits-it’s about controlling the price drop. A 2011 Federal Trade Commission report found that when brand companies launched authorized generics during the 180-day exclusivity period, prices were 15-20% lower than in markets without them. Why? Because now there are two low-cost options competing, not just one. Between 2010 and 2019, there were 854 authorized generic launches, according to a Health Affairs study. That’s about 15-20% of all generic entries in that time. And it’s not slowing down. By 2027, Evaluate Pharma predicts 45% of major branded drugs will have authorized generics introduced within a year of patent expiry.Authorized Generics vs. Traditional Generics: What’s the Real Difference?

Here’s where confusion sets in. Most people think “generic” means cheaper, different-looking, maybe less effective. But authorized generics break that mold.| Feature | Authorized Generic | Traditional Generic |

|---|---|---|

| Manufacturer | Original brand company | Separate generic manufacturer |

| Active Ingredients | Identical to brand | Identical to brand |

| Inactive Ingredients | Identical to brand | May differ |

| FDA Approval Pathway | Under brand’s NDA | Through ANDA |

| Appears in Orange Book? | No | Yes |

| Price vs. Brand | 30-70% lower | 80-90% lower |

| Therapeutic Consistency | High-same formulation | Variable-inactive ingredients can affect absorption |

Who Benefits? Who Gets Left Out?

Consumers often win-at least in the short term. Lower prices during the 180-day window mean cheaper prescriptions. Pharmacy benefit managers like Express Scripts and OptumRx actively push authorized generics because they’re seen as higher quality than traditional generics. In one 2021 analysis, Express Scripts found 28% higher utilization of authorized generics compared to traditional ones. But here’s the catch: the long-term picture isn’t so clear. Critics argue that authorized generics aren’t about lowering prices-they’re about blocking competition. By flooding the market with their own version, brand companies make it harder for independent generic manufacturers to gain traction. The Generic Pharmaceutical Association (GPhA) says this delays broader generic entry, keeping prices higher than they’d be otherwise. And then there’s the patient experience. A 2023 survey by Pharmacy Times found that 68% of pharmacists say patients are confused. One patient wrote on Drugs.com: “I got this ‘generic’ but it looks identical to the brand I used before-is this actually generic?” That’s the paradox. Authorized generics are the most faithful copy of the brand. But because they look the same, patients think they’re getting the brand. Or worse-they think they’re being tricked.Pharmacies Are Struggling to Keep Up

This confusion isn’t just in patients’ heads. It’s in the pharmacy systems too. Pharmacists don’t get training on authorized generics. They’re not in the Orange Book. They’re not flagged in most electronic health records. A 2021 survey by the National Community Pharmacists Association found that 57% of independent pharmacies saw a spike in patient questions after the FDA pushed for clearer labeling in 2019. Billing is another headache. Some insurance systems don’t recognize authorized generics as “generic,” so they charge the brand price. Others miscode them as brand-name drugs, leading to denied claims. A 2022 AmerisourceBergen report said 41% of pharmacies reported billing issues. The fix? Software updates. Epic Systems added a specific flag for authorized generics in 2021. Pharmacies using it saw a 67% drop in identification errors. But not everyone has upgraded. Many still rely on pharmacists to remember which pills are which-and that’s not reliable.

The Future: More Authorized Generics, But for How Long?

The FDA now lists 1,247 authorized generics as of October 2025. That’s up from just a few hundred in 2015. And it’s not slowing. CNS drugs like antidepressants and ADHD meds lead the pack-67% adoption-because consistency matters most there. Antibiotics? Only 22%. Why? Because small formulation changes don’t usually break them. But pressure is building. In 2023, Congress introduced the “Promoting Competition in Pharmaceutical Markets Act,” which would ban brand companies from launching authorized generics during the 180-day exclusivity window. If it passes, it could change the game. Some analysts think we’re nearing saturation. Bernstein Research predicts market decline by 2027 as more generic companies get smarter and prices keep falling. Others, like Jefferies, believe authorized generics will keep growing through 2030-especially as more blockbuster drugs lose patents. One thing’s certain: authorized generics aren’t going away. They’re not a glitch in the system. They’re a feature. A complex, messy, controversial feature-but one that’s here to stay.What Should You Do as a Patient?

If your prescription switches to a generic and it looks exactly like your brand pill? Don’t panic. It might be an authorized generic. Ask your pharmacist: “Is this the same as the brand?” If they say yes, it’s probably an authorized generic. And that’s a good thing. For drugs where small changes matter-thyroid meds, blood thinners, epilepsy drugs-ask specifically for the authorized generic. You’ll get the same stability you had with the brand, at a lower price. And if you’re confused? You’re not alone. Millions are. But understanding the difference isn’t just about saving money-it’s about staying safe.Are authorized generics the same as brand-name drugs?

Yes, authorized generics are identical to their brand-name counterparts in both active and inactive ingredients. They’re made on the same production line, using the same formula. The only difference is the label-no brand name, lower price.

Why aren’t authorized generics listed in the FDA’s Orange Book?

The Orange Book only lists drugs approved under an Abbreviated New Drug Application (ANDA). Authorized generics are marketed under the original brand’s New Drug Application (NDA), so they don’t need separate FDA approval. That’s why they’re not included in the Orange Book, even though they’re therapeutically equivalent.

Do authorized generics cost less than traditional generics?

Usually not. Traditional generics are typically cheaper because they’re made by competing manufacturers with no brand overhead. Authorized generics are priced lower than the brand but often higher than traditional generics-because they’re still produced by the original company.

Can authorized generics cause side effects?

No more than the brand-name version. Since they’re chemically identical, side effects should be the same. In fact, for patients who had bad reactions to traditional generics due to different inactive ingredients, authorized generics often resolve those issues.

How do I know if I’m getting an authorized generic?

Ask your pharmacist. Authorized generics often look identical to the brand name, so you can’t tell by appearance. The pharmacy’s system should flag them, but not all do. Look for the manufacturer name on the bottle-sometimes it’s the same as the brand (e.g., Pfizer’s Greenstone). If the label says “generic” but looks exactly like your brand pill, it’s likely an authorized generic.

Are authorized generics covered by insurance the same way as brand-name drugs?

It depends. Some insurance plans treat them as brand-name drugs and charge higher copays. Others classify them as generics. Always check with your plan or pharmacist before filling. If you’re being charged brand prices for what you thought was a generic, ask for clarification.

Comments(8)